The Evolving Challenges in Healthcare Practice Management

How Much Revenue Are You Really Losing?

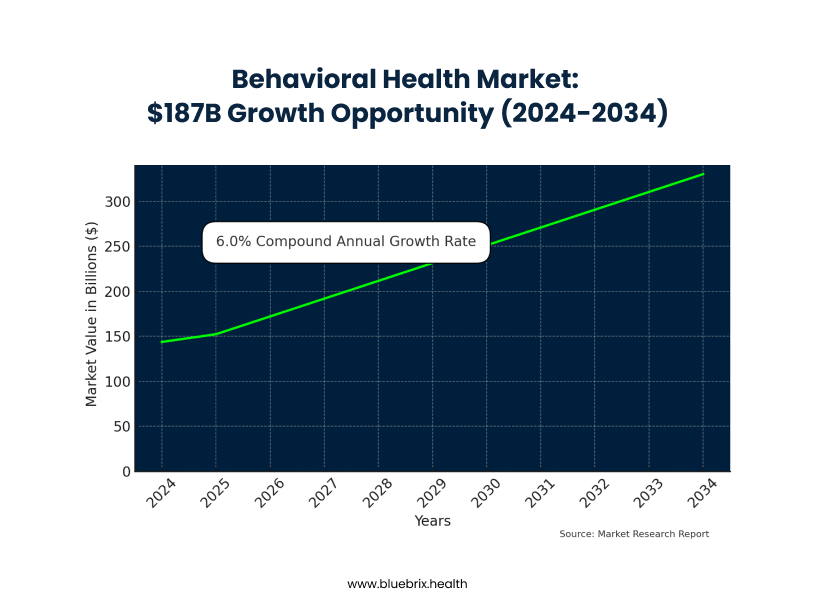

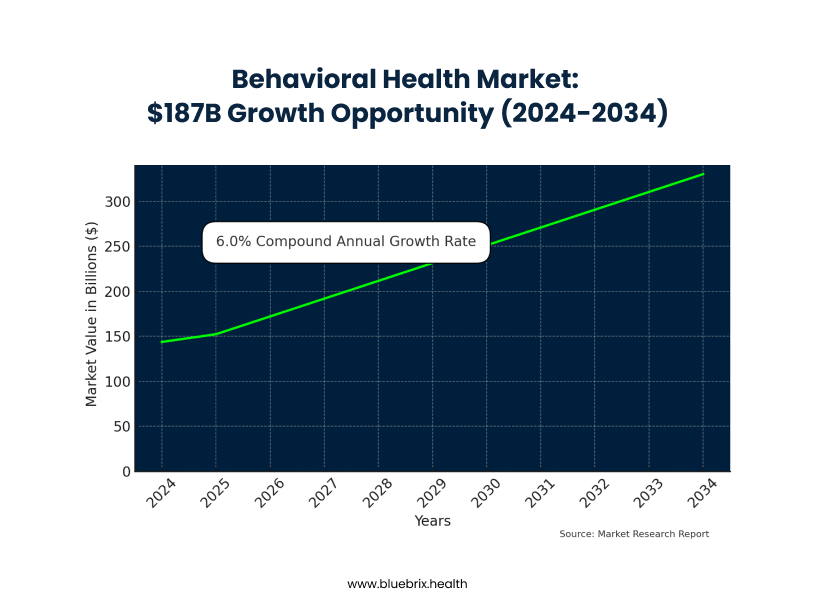

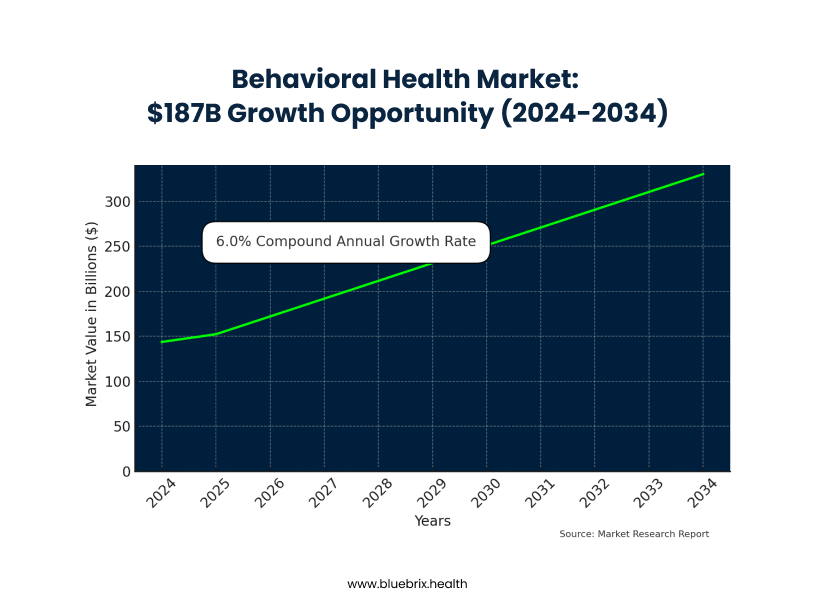

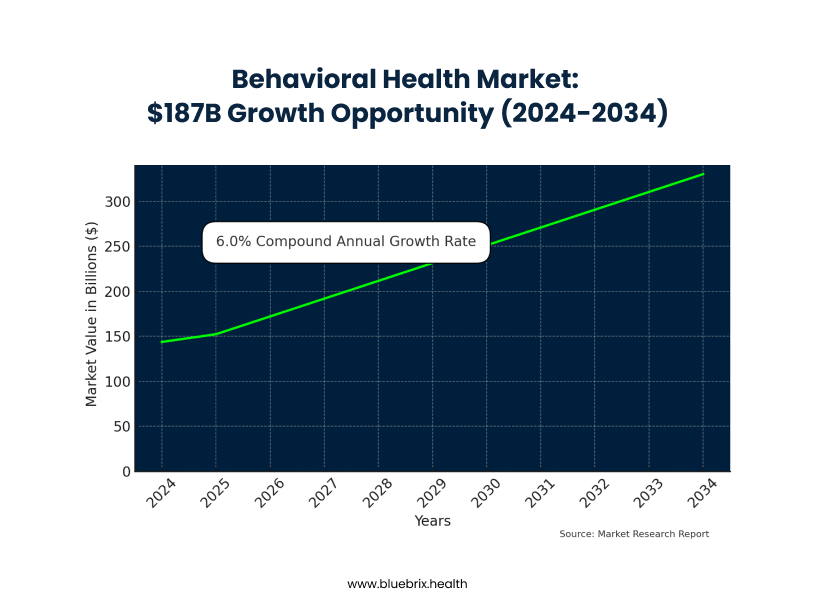

Imagine losing potential revenue because your front desk is stuck on hold with Blue Cross, desperately trying to verify a patient’s insurance. This frustrating scenario is a daily reality for behavioral health practices, leading to significant financial losses and administrative chaos. While the behavioral health market is booming, projected to grow from $143.74 billion in 2024 to $330.35 billion by 2034, your practice likely struggles with unique administrative burdens that other medical specialties don’t face.

Behavioral health is an administrative nightmare by design. Unlike standardized medical procedures, you navigate crisis interventions, diverse therapy modalities, medication management, and substance abuse treatments, each with complex, ever-changing insurance rules. Your claims are individually worth less, yet require just as much administrative effort, creating a “behavioral health penalty” where the overhead per dollar earned is crushing.

This administrative burden doesn’t just impact your bottom line; it drives patients away. A staggering 30% of potential patients abandon treatment before booking due to insurance uncertainties. This “patient exodus” means lost revenue, missed opportunities for early intervention, and a devastating ripple effect on your practice’s growth and mission.

The daily grind of manual insurance verification is killing your staff and mission. Your team spends hours on frustrating phone calls, battling outdated information and constant rule changes. This leads to a revenue cycle nightmare: denied claims, surprise bills for patients, eroded trust, and unpredictable cash flow. Inaccurate information, often due to human error, directly causes these denials, necessitating costly appeals and diverting staff from patient care. AI-powered insurance verification offers a transformative solution to these pervasive challenges

Need for Adaptable EHR Solutions in Value-based Care

How Much Revenue Are You Really Losing?

Imagine losing potential revenue because your front desk is stuck on hold with Blue Cross, desperately trying to verify a patient’s insurance. This frustrating scenario is a daily reality for behavioral health practices, leading to significant financial losses and administrative chaos. While the behavioral health market is booming, projected to grow from $143.74 billion in 2024 to $330.35 billion by 2034, your practice likely struggles with unique administrative burdens that other medical specialties don’t face.

Behavioral health is an administrative nightmare by design. Unlike standardized medical procedures, you navigate crisis interventions, diverse therapy modalities, medication management, and substance abuse treatments, each with complex, ever-changing insurance rules. Your claims are individually worth less, yet require just as much administrative effort, creating a “behavioral health penalty” where the overhead per dollar earned is crushing.

This administrative burden doesn’t just impact your bottom line; it drives patients away. A staggering 30% of potential patients abandon treatment before booking due to insurance uncertainties. This “patient exodus” means lost revenue, missed opportunities for early intervention, and a devastating ripple effect on your practice’s growth and mission.

The daily grind of manual insurance verification is killing your staff and mission. Your team spends hours on frustrating phone calls, battling outdated information and constant rule changes. This leads to a revenue cycle nightmare: denied claims, surprise bills for patients, eroded trust, and unpredictable cash flow. Inaccurate information, often due to human error, directly causes these denials, necessitating costly appeals and diverting staff from patient care. AI-powered insurance verification offers a transformative solution to these pervasive challenges

blueEHR Overview

How Much Revenue Are You Really Losing?

Imagine losing potential revenue because your front desk is stuck on hold with Blue Cross, desperately trying to verify a patient’s insurance. This frustrating scenario is a daily reality for behavioral health practices, leading to significant financial losses and administrative chaos. While the behavioral health market is booming, projected to grow from $143.74 billion in 2024 to $330.35 billion by 2034, your practice likely struggles with unique administrative burdens that other medical specialties don’t face.

Behavioral health is an administrative nightmare by design. Unlike standardized medical procedures, you navigate crisis interventions, diverse therapy modalities, medication management, and substance abuse treatments, each with complex, ever-changing insurance rules. Your claims are individually worth less, yet require just as much administrative effort, creating a “behavioral health penalty” where the overhead per dollar earned is crushing.

This administrative burden doesn’t just impact your bottom line; it drives patients away. A staggering 30% of potential patients abandon treatment before booking due to insurance uncertainties. This “patient exodus” means lost revenue, missed opportunities for early intervention, and a devastating ripple effect on your practice’s growth and mission.

The daily grind of manual insurance verification is killing your staff and mission. Your team spends hours on frustrating phone calls, battling outdated information and constant rule changes. This leads to a revenue cycle nightmare: denied claims, surprise bills for patients, eroded trust, and unpredictable cash flow. Inaccurate information, often due to human error, directly causes these denials, necessitating costly appeals and diverting staff from patient care. AI-powered insurance verification offers a transformative solution to these pervasive challenges

Core Functionalities of blueEHR

How Much Revenue Are You Really Losing?

Imagine losing potential revenue because your front desk is stuck on hold with Blue Cross, desperately trying to verify a patient’s insurance. This frustrating scenario is a daily reality for behavioral health practices, leading to significant financial losses and administrative chaos. While the behavioral health market is booming, projected to grow from $143.74 billion in 2024 to $330.35 billion by 2034, your practice likely struggles with unique administrative burdens that other medical specialties don’t face.

Behavioral health is an administrative nightmare by design. Unlike standardized medical procedures, you navigate crisis interventions, diverse therapy modalities, medication management, and substance abuse treatments, each with complex, ever-changing insurance rules. Your claims are individually worth less, yet require just as much administrative effort, creating a “behavioral health penalty” where the overhead per dollar earned is crushing.

This administrative burden doesn’t just impact your bottom line; it drives patients away. A staggering 30% of potential patients abandon treatment before booking due to insurance uncertainties. This “patient exodus” means lost revenue, missed opportunities for early intervention, and a devastating ripple effect on your practice’s growth and mission.

The daily grind of manual insurance verification is killing your staff and mission. Your team spends hours on frustrating phone calls, battling outdated information and constant rule changes. This leads to a revenue cycle nightmare: denied claims, surprise bills for patients, eroded trust, and unpredictable cash flow. Inaccurate information, often due to human error, directly causes these denials, necessitating costly appeals and diverting staff from patient care. AI-powered insurance verification offers a transformative solution to these pervasive challenges